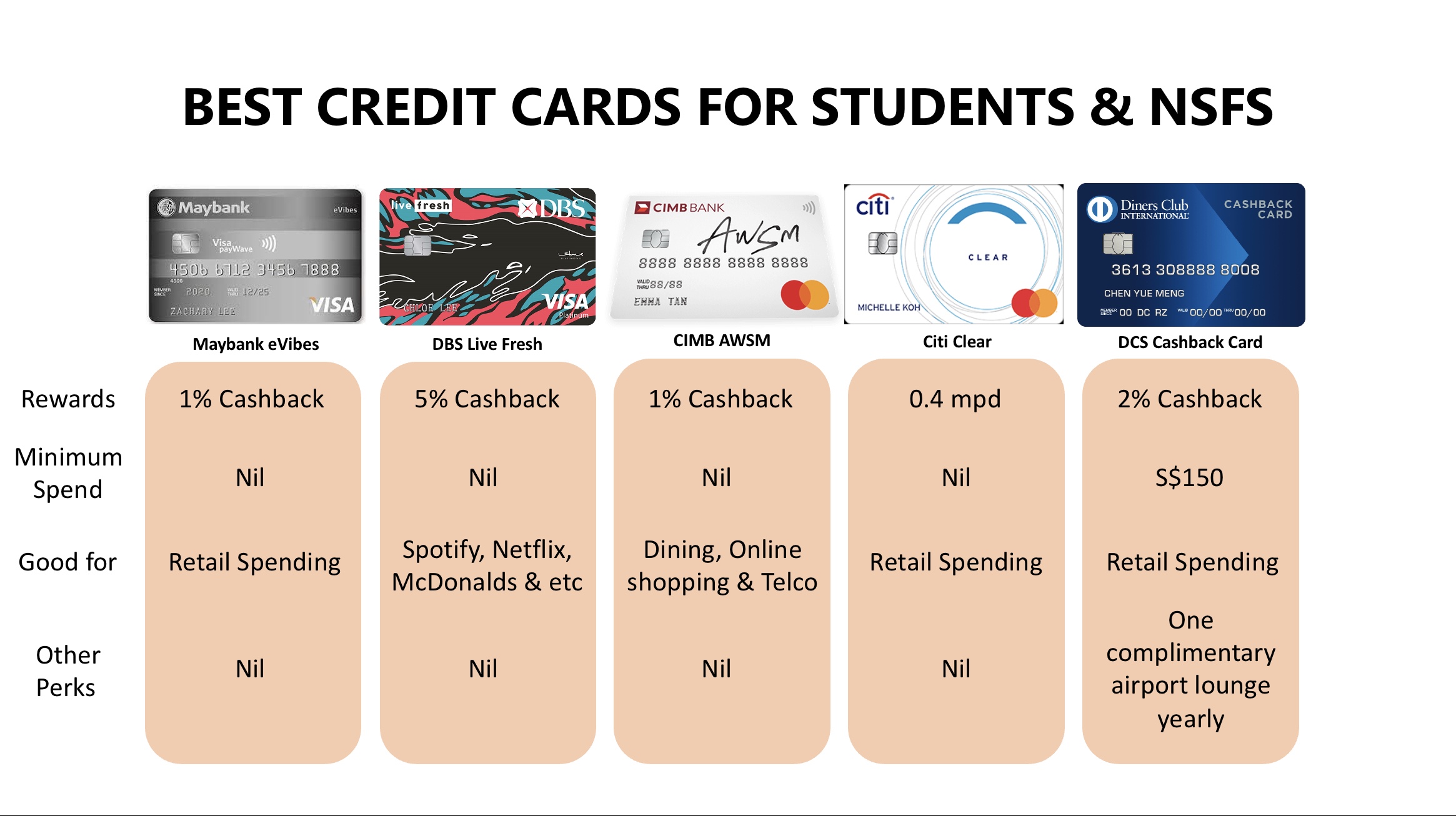

While most credit cards require an income of least S$30k a year to get one, there are still a few credit cards that have a more relaxed requirement in terms of income.

Student credit cards are typically geared towards students who are at least 18 years old, those are ones without any credit history. Rather than most credit cards which offer a credit limit at least 2-3 times your salary, student credit cards have a credit limit of S$500.

Some banks also allow applicants who are not students but earning less than S$30k annually (subjected to banks requirements) to also apply for one.

| Card | Cashback rate | Age | Must be enrolled in an education institution? |

| Maybank EVibes | 1% cashback | 18-30 years old | Yes (LASALLE, NAFA, NIE, NP, NTU, NUS, NYP, RP, SIT, SMU, SP, SUSS, SUTD, TP & SIM) |

| DBS Live Fresh (Student) | Up to 5% cashback with eligible merchants and eco-merchants (Capped at S$15 each) Up to 0.3% on other spends (Capped at S$20) | 21-27 years old | Yes (NP, NTU, NUS, NYP, RP, SIT, SMU, SP, SUSS, SUTD, TP & SIM) |

| CIMB AWSM | 1% cashback on Dining & Entertainment, Online Shopping & All Things Telco | 18 years and above | No |

| GXS Flexi Card | Random cashback amount up to S$3 for every transaction at least S$10 | 21 – 55 years | No |

| Citi Clear Card | 1X ThankYou Point for every S$1 spent (0.4 mpd) | 18 years and above | Yes |

| DCS Diners Club Cashback Card (S$500) | 2% Cashback (Capped at S$10, minimum spend of S$150) | 18 years and above | No |

Maybank eVibes – Best credit card for students

Features:

| Features | |

| Cashback | 1% |

| Credit Limit | S$500 |

| Annual Fee | $0 (S$5 service fee/quarter if no spending made within the same quarter, waived for first 2 years) |

| Mobile Wallet | Apple Pay and Samsung Pay |

One of the best student credit cards for students is the Maybank eVibes as it gives 1% cashback on all retail spending without any minimum spending required.

While this card does not have annual fees, it charges S$5 service fee every quarter if the card is not used at least once each quarter. However, this service fee is waived automatically for the first two years.

It is also important to note that only non-Maybank credit card or CreditAble members who are enrolled in an educational institution (NSFs just need to show proof that they have been accepted into the education institution) stated above are eligible to apply. They must also not be earning S$30k and above and be between the ages of 18-30 years old.

Sign-up bonus: From 1 April 2023, apply for the Maybank eVibes Card and charge a minimum of S$150 of eligible transactions for the first 2 consecutive months upon approval of your new Card, to receive an American Tourister luggage worth S$240.

DBS Live Fresh (Student) – Best for seeking cashback value

| Features | |

| Cashback | Up to 5% cashback with eligible merchants (Capped S$15) Up to 5% cashback with eco-merchants (Capped S$15) Up to 0.3% on other spends (Capped S$20) |

| Credit Limit | S$500 |

| Annual Fee | S$192.60 (Waived for first 5 years) |

| Mobile Wallet | Apple Pay, Google Pay and Samsung Pay |

If you spend on Golden Village, Starbucks, McDonald’s, Netflix, Spotify and eco-friendly partners regularly, this card might be for you. Giving up to 5% on eligible merchants as well as eco-friendly partners (capped at S$15 each per month), it is one of the highest cashback given for a student credit card. One example of the eco-friendly spending is public transport, which allows you to earn 5% cashback on your public transport rides. Other transactions would reward a 0.3% cashback capped at S$20 per month. Another good thing about this card is that there is no minimum spending required to attain the cashback.

While the cashback given is high, its annual fees are also quite high at S$192.60 per year. But the good news is that this annual fee is waived for the first five years.

CIMB AWSM – Best no annual fees student credit card

| Features | |

| Cashback | 1% on Dining & Entertainment, Online Shopping and Telco (Singtel, M1, Starhub, Circles.Life, and MyRepublic) |

| Credit Limit | S$500 |

| Annual Fee | S$0 |

| Mobile Wallet | Google Pay and Samsung Pay |

Unlike any of the cards here, the CIMB AWSM has no annuel fees. It gives a 1% cash back on categories such as Dining & Entertainment, Online Shopping and Telco (Singtel, M1, Starhub, Circles.Life, and MyRepublic). It is great, especially for students as no minimum spending is required too.

This card can be applied by students, NSFs (no income required) as well as working adults who meet the income requirements:

- For ages below 35: S$18,000

- For ages 35 and above: S$30,000

But of course, if you are earning S$30,000 and above, you should consider other credit cards that give better rewards such as the HSBC Revolution Credit Card which has no annual fees and gives up to 4 mpd (2.5% cashback).

GXS Flexi Card – No Income Requrement

| Features | |

| Cashback | Random up to S$3 |

| Credit Limit | S$500 |

| Annual Fee | S$54.50 |

| Mobile Wallet | No |

GXS Flexi Card targets users who don’t qualify for any of the cards above. It is a good card to help build credit score. Even though credit scores are not as important as in the US, but it still plays a factor in being able to apply for a credit card in future.

Citi Clear Card – For students earning miles

| Features | |

| Rewards | Earn 1X Reward for every S$1 spend (0.4mpd) |

| Credit Limit | S$500 |

| Annual Fees | S$30.24 (First year waived) |

| Mobile Wallet | Apple Pay, Google Pay and Samsung Pay |

Citi Clear Card rewards users with Citi ThankYou points rather than actual cashback, which is great for users who are trying to get into the miles game. It rewards 1 Citi ThankYou point (0.4mpd) for every $1 spent, which can go towards paying for specific purchases or redeeming flights. However, in my opinion, you are better off using a Chocolate Visa Debit card to get 2mpd on almost any purchase, capped at S$1000 per month.

Citi Clear Card has a rather lenient eligibility policy on the institution you have to be in to apply, having the most number of schools in the eligibility requirements compared to other cards. This makes it easy for students not studying in a mainstream educational institution to apply for one.

DCS Diners Club Cashback Card (S$500) – Great for free airport lounge visit

| Features | |

| Cashback | 2% (min S$150 spend per month) |

| Credit Limit | S$500 |

| Annual Fees | S$28 (First year free) |

| Mobile Wallet | Nil |

| Additonal Perks | One complimentary airport lounge visit annually |

Unlike the other credit cards mentioned here, the DCS Diners Club Cashback Card is not heavily marketed as a student credit card as compared to others. Still, they do offer a S$500 version of the credit card to students and NSF with no income required.

Even though Diners Club is not as widely accepted compared to the other cards here, it offers a rather attractive 2% cashback with a minimum spend of S$150.

One perk that comes with this card is one complimentary airport lounge visit annually, which no other student credit card offers.

Ending statement

While having a credit card helps you earn rewards, it is important to remember to pay the full balance of your credit card statement timely, don’t just pay the minimum amount as credit card interest rates are high and the rest of the unpaid balance will be subject to those interest rates. This also helps you build a better credit score.