As a frugal guy, I’ve been researching and trying various debit cards to get the best value out of it.

Yes, credit cards do offer generous sign-up gifts and cashbacks but generally, most will have strings attached like “spend a minimum of $xxxx per month” or something along that line.

While debit cards do not come with great rewards and cashback unlike a credit card, there are some debit cards that offer considerable rewards while not needing to break the bank to qualify. Here are some to consider.

| Card | Rewards | Cons | Best for |

Standard Chartered Cashback Card | 1% cashback on spendings | Capped at $60/month | Low spenders |

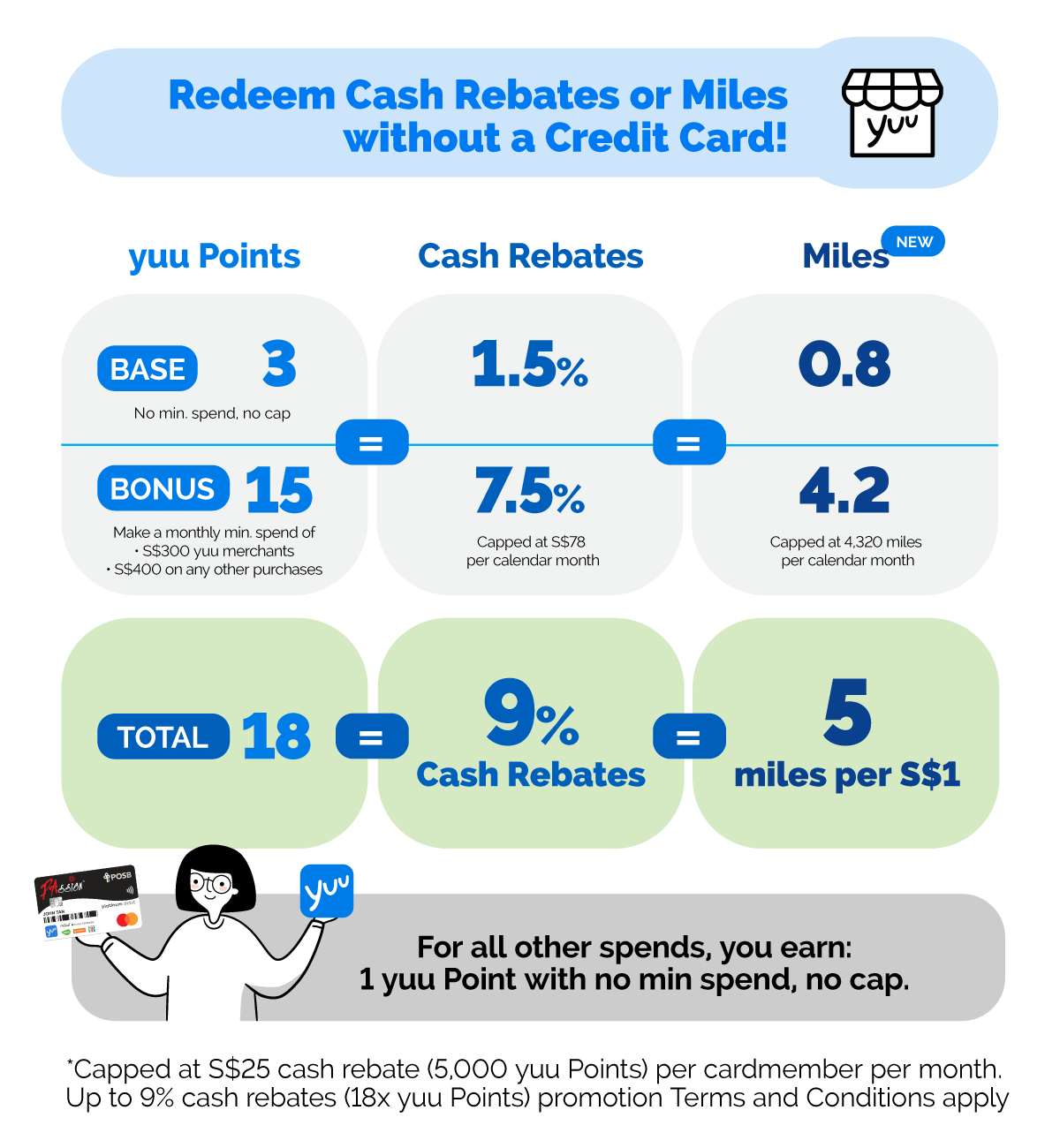

POSB PAssion Debit card | Up to 8% rebate on spending on Yuu merchants | Base – 1.5% rebate Selected products – up to 1% rebate $50 spent in a single receipt at Dairy Farm/BreadTalk Group outlets – 2.5% rebate (capped 1500 yuu points) $300 spent per month at Dairy Farm/BreadTalk Group outlets – 3% rebate (capped 1800 yuu points) | Spending at Yuu merchants |

Trust Bank card (Debit) | – Up to 11% Cashback on FPG – Sign up bonus: S$35 FairPrice e-voucher + 400g Milo softpack with referral code, V4859EJ3 | – Minimum $200 spend outside FPG to qualify – No cashback on spendings outside FPG | Those who spend at FPG |

UOB One debit card | Up to 10% cashback | – 10% cashback for new UOB customers only (1% to 3% for existing UOB customers depending on merchants) – Cashback is on selected merchants, capped at S$20 per month – Minimum spending of $500/month to qualify – Annual fee of S$18.17 if less than 12 transactions per year (Fee waiver for first 3 years) | Those who spend on Shopee Singapore, Dairy Farm International, SimplyGo & Grab |

List of debit cards

- Standard Chartered Cashback card

- POSB PAssion Debit Card

- Trust Bank Card (Debit)

- UOB One Card (Debit)

- Social media links

Standard Chartered Cashback card

The Standard Chartered Cashback card is a debit card that is given to Standard Chartered Bank account holders. It gives a 1% cashback on any elibigle MasterCard transaction. It is a card that I would recommending using if you do not spend a large sum of money per month as there is no minimum spending required to enjoy the cashback.

However, do note that the maximum cashback amount per month is $60 (about $6k)

POSB PAssion Debit Card

The POSB Passion debit card is given to users holding a POSB Savings Account, DBS Savings Plus Account, DBS Autosave Account or DBS Current Account. DBS My Account holders will not be able to link to this card.

It offers up to 8% rebate and while there is no minimum spending required, you only will earn 1.5% rebate if you do not hit the spending requirements. You will also earn 1% cashback at Takashimaya (no minimum spend), enjoy 1 for 1 attractions deals on every 10th of the month and a free PAssion card membership (worth $12).

This is a card to consider if you spend at Yuu merchants regularly as you earn accelerated Yuu points.

Trust Bank Card (Debit)

The Trust Bank card is given to Trust Bank account holders. If you do not qualify for a credit card, you still can earn up to 11% rebate (For non-NTUC Union members, 5% rebate) on FPG spending with a minimum spend of $200 outside FPG.

If you spend regularly at FairPrice Group, it might be worth using this card as you would need to spend at least $200 outside FairPrice Group to qualify for the rebate at FairPrice Group. Do note that you will not earn any rebates for spending outside FPG.

Currently, Trust Bank is offering $35 worth of FairPrice e-vouchers ($10 for using my referral link + $25 for signing up) when you sign up for their bank account. On top of that, you get one free 400g Milo softpack after signing up, which can be redeemed at any FairPrice outlets. To get started, just download the Trust app and sign up with my referral code, V4859EJ3.

UOB One Card (Debit)

The UOB One debit card is given to UOB bank account holders. It comes in both the MasterCard and Visa version, though both offers the same perks. It is the only card that imposes an annual fee if you do not use the card 12 times per year. However, it gives attractive cashback rates especially to new UOB users, akin to certain credit cards.

Cashback is only applicable for spendings at Shopee Singapore, Dairy Farm International, SimplyGo & Grab. Moreover, there is a minimum spending of $500 to qualify.

Cashback is also capped at S$20 per month, which brings the effective cashback rate to 4% if you were to spend $500 at the applicable merchants (if you qualify for the 10% cashback as a new UOB customer). For existing customers, cashback is also capped at S$20 per month with the cashback rate ranging from 1% for Grab purchases to 3% for Shopee, DFI and SImplyGo.