Why carry around cold hard cash when you can simply just tap and pay with a piece of plastic (or even just a phone)

Imagine exchanging for foreign currency notes for relatively poor exchange rates, and not even rewards like cashback or points for those spendings in return. In this day and age, you should not be doing that.

Instead, turn to multi-currency cards where they offer competitive exchange rates as well as rewards on such spendings.

These cards, unlike traditonal bank cards, don’t charge; foreign exchange fees, service fee, poor exchange rates.

After using many multi-currency cards for purchases made in foreign currency, I feel these 4 cards offer the best value for money when making such purchases, depending on different cases.

List of cards:

Instarem Amaze

For users with a Mastercard credit card card offering high rewards

Instarem is a digital cross-border payment service that offers highly competitive rates for overseas money transfer. It is operated by Nium, which holds the Payment Services Act license, regulated by Monetary Authority of Singapore.

One of the products offered by Instarem is it’s card. The main reason for getting this card is that you are allowed to link up to five Mastercard debit or credit cards, which eliminates the need to carry multiple cards. This means that you would not need to top up your Instarem Amaze card – something I’ll highly discourage you from doing.

| Pros | Cons |

| 1. Earn the usual high credit card rewards by retaining merchant MCC | 1. Slighly poorer exchange rates as compared to banks |

| 2. Exchange rates better than directly using bank credit card | 2. High ATM withdrawal fees |

| 3. Google Pay/Apple Pay support |

As you have notice in the cons, one of it is the slighly poorer exchange rate. The exchange rate mark up is usually around 2% from the spot rate.

However, this is made up by the high credit card rewards which is usually 4mpd for most specialised spending cards like Citi Rewards MasterCard and UOB Lady’s Card, or even up to 10% with the MayBank Family & Friends card. Moreover, you get Instapoints which can be redeemed at 1000 points for S$5 (additional 0.25% cashback).

You should however not make ATM withdrawals with this card as it charges high fees for doing so. Other than that, it is a good card to pair with your credit card.

If you do not have an Instarem account, do sign up using my referral link (7R22om) to get 200 InstaPoints.

Tiger BOSS Debit Card

For users seeking better exchange rates while getting some rewards

Tiger BOSS Debit Card was recently launched by Tiger Brokers. It is their latest product in addition to their minimal fee brokerage platform.

It is the first ever debit card that allows you to earn 1% cashback in fractional shares on your purchases. Currently, it rewards in terms of Nvidia (NVDA) shares, which has recently gain popularity for its stock returns.

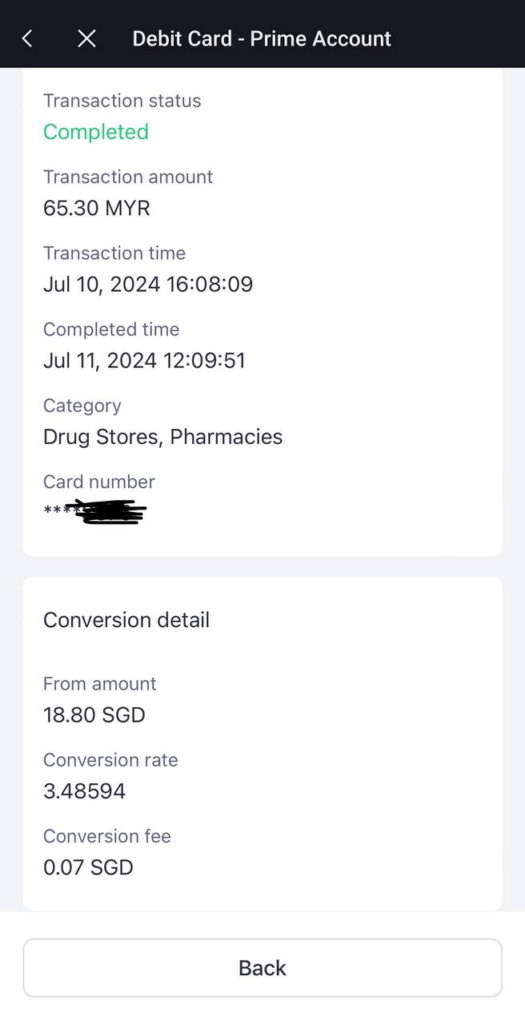

Being a card that is powered by Wise, a popular foreign money transfer company, it offers competive exchange rate – at spot exchange rate + roughly a 0.3% transaction fee. This basically means an effective cashback rate of 0.7% from the spot rate. Below shows an example of a transaction made with the Tiger Boss Debit Card.

For those who cannot qualify for a credit card eg. students, this is a card that you can consider using.

| Pros | Cons |

| 1. 1% cashback in fractional shares | 1. Need to accumulate at least S$1 in total cashback (can be multiple transactions) for it to convert to fractional shares |

| 2. Exchange rate at spot rate + 0.3% transaction fee | 2. High ATM withdrawal fees (S$5 + 2% service fee per transaction) |

| 3. Google Pay & Apple Pay support | 3. S$15 for replacement card |

| 4. Withdrawable back to trading account or bank account |

You should however not make ATM withdrawals with this card as it charges high fees for doing so. But if not, it is a good debit card to use overseas

If you do not have a Tiger Boss card, you can consider using my referral link to get S$5 credit from Tiger Brokers upon your first transaction. Without the referral link, you would not earn the S$5 incentive.

To get a Tiger Boss card, you also need to have a Tiger Brokers account. You can sign up for an account here where you can also get sign up gifts here.

Trust Bank Debit card

Trust Bank is a digital bank backed by Standard Chartered and FairPrice Group that started operations in 2022. Their bank account comes with a card which doubles as both a debit and a credit card. To not incur any additional fees, the card should be in the debit card mode.

| Pros | Cons |

| 1. Minimal mark up (similar to most multi-currency cards) | 1. Low cashback rate (net negative earn rate of 0.08% assuming 0.3% – 0.22%) |

| 2. 0.22% cashback in Linkpoints | |

| 3. No ATM Fees when using debit card mode overseas | |

| 4. Apple Pay and Google Pay support |

If you haven’t sign up for a Trust Bank account, do sign up using my referral code, V4859EJ3. You’ll get a S$10 FairPrice E-Voucher + S$25 FairPrice E-Voucher after your first purchase (does not have to be FairPrice purchase). These vouchers do not have a minimum spending amount.

Disclaimer: Any views or opinions represented in this post are personal and being solely to me and do not represent those of people, institutions or organisations that I may or may not be associated with in professional or personal capacity, unless explicitly stated. Please exercise due diligence when signing up for any service/product as I will not be liable for any personal loss, financial or otherwise. None of the information here constitutes personal financial advice. Thank you for supporting my site!

Heya i’m for the first time here. I found this board and I find It

really useful & it helped me out much. I hope to give something back and aid others like you helped

me.